Is your Business Protected from Cyber Attacks with Cyber Liability Insurance?

In today’s digital age, every business, regardless of size, is at risk of cyber threats. At Dickerson Agency, Inc., we understand the unique challenges that small businesses face in protecting their sensitive information and maintaining the trust of their customers. Our Cyber Liability Insurance is designed to provide comprehensive protection against a wide range of cyber risks, ensuring that your business remains secure and resilient.

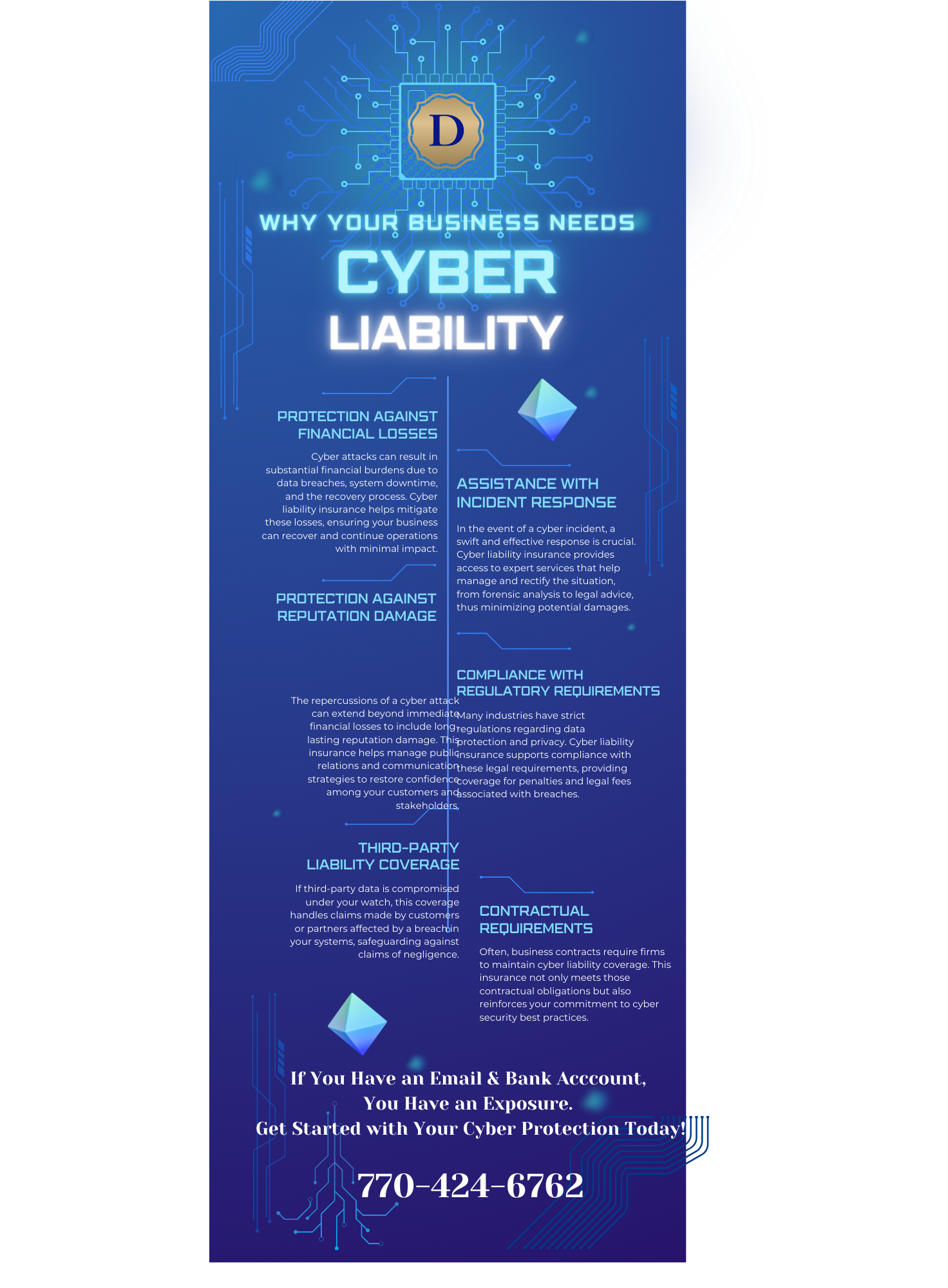

Why Your Business Needs Cyber Insurance

Safeguard Sensitive Information

As a small business, you handle sensitive information such as customer data, financial records, and proprietary business information. A cyber attack can compromise this data, leading to significant financial and reputational damage.

Legal and Regulatory Compliance

Many industries are subject to strict data protection regulations. A data breach can result in hefty fines and legal consequences if your business is not in compliance with these regulations. Cyber Liability Insurance helps cover these costs and ensures you meet your legal obligations.

Financial Protection

The financial impact of a cyber incident can be devastating. Costs can include legal fees, notification expenses, credit monitoring for affected individuals, and potential settlements. Cyber Liability Insurance provides financial support to help your business recover from these unexpected expenses.

Types of Cyber Threats

Data Breaches

Unauthorized access to sensitive data can occur through hacking, phishing, or malware attacks. These breaches can expose confidential information, leading to financial loss and damaged reputation.

Ransomware Attacks

Ransomware is a type of malware that encrypts your business’s data, holding it hostage until a ransom is paid. Even small businesses are targets, and the cost of ransom and recovery can be substantial.

Business Interruption

Cyber attacks can disrupt your business operations, resulting in lost revenue and additional expenses to restore normalcy. Cyber Liability Insurance covers business interruption losses, helping you get back on track quickly.

Social Engineering Fraud

Cyber criminals often use deceptive tactics to trick employees into revealing confidential information or transferring funds. Social engineering fraud can have severe financial consequences for your business.

Benefits of Cyber Liability Insurance

Comprehensive Coverage

Our Cyber Liability Insurance provides extensive coverage, including data breach response, legal defense, regulatory fines, and business interruption losses. We ensure that your business is protected from a wide range of cyber threats.

Expert Support

In the event of a cyber incident, having the right support is crucial. Our policy includes access to cybersecurity experts who can help mitigate the damage, manage the response, and guide you through the recovery process.

Peace of Mind

With Cyber Liability Insurance from Dickerson Agency, Inc., you can focus on running your business, knowing that you have robust protection against cyber risks. Our goal is to provide you with peace of mind, ensuring that your business is prepared for any digital threats that come your way.

Contact Us

Protect your business from the ever-evolving cyber threats with Cyber Liability Insurance from Dickerson Agency, Inc. Contact us today to learn more about our coverage options and how we can help safeguard your business’s digital assets. Or get started on your quote now!